With the European Union’s ambitious sustainable finance agenda, the need for reliable, comprehensive, and standardised sustainability data is more pressing than ever.

The introduction of the EU Taxonomy—a classification system establishing a list of environmentally sustainable economic activities—adds layers of regulatory obligations that many companies are navigating for the first time. However, in their efforts to gather and report the necessary data for EU Taxonomy compliance, both corporates and investors are confronting considerable financial and operational challenges.

The EU Taxonomy, within its broader framework, aims to support the European Green Deal.

It provides a detailed and science-based set of criteria that define which economic activities can be deemed sustainable, covering six environmental objectives (e.g. Climate Change Mitigation).

What are the choices for investors looking to integrate EU Taxonomy data into their reports?

1. Company Disclosures

Investors can utilise Annual Reports and Sustainability Reports, where large EU companies are required to disclose their alignment with the EU Taxonomy. This includes the percentage of revenues, capital expenditure (CapEx), and operational expenditure (OpEx) related to Taxonomy-aligned activities, including specific sub-categories of KPIs. Soon under the Corporate Sustainability Reporting Directive (CSRD), Non-Financial Reporting will provide more granular Taxonomy-aligned information and on a much larger pool of companies.

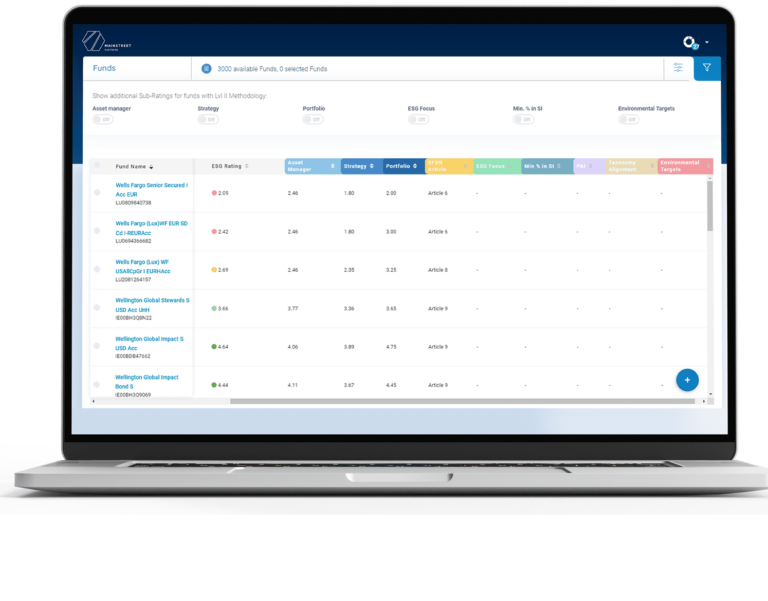

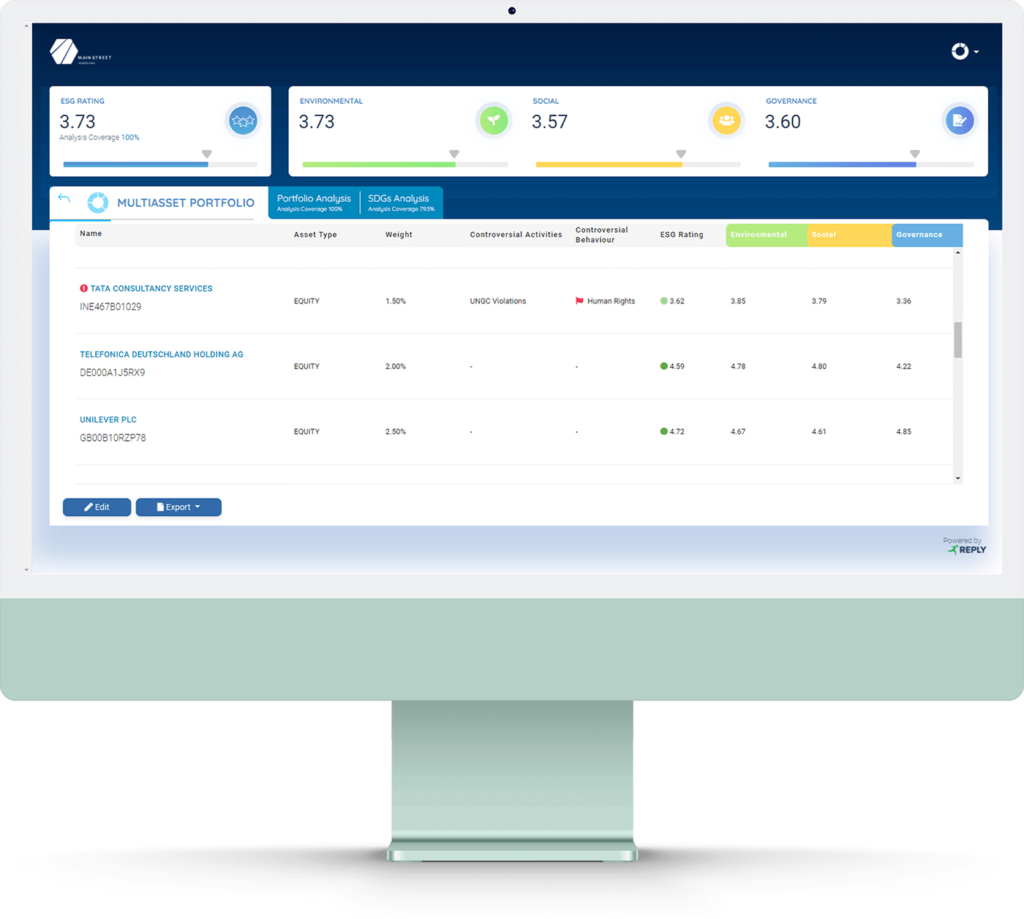

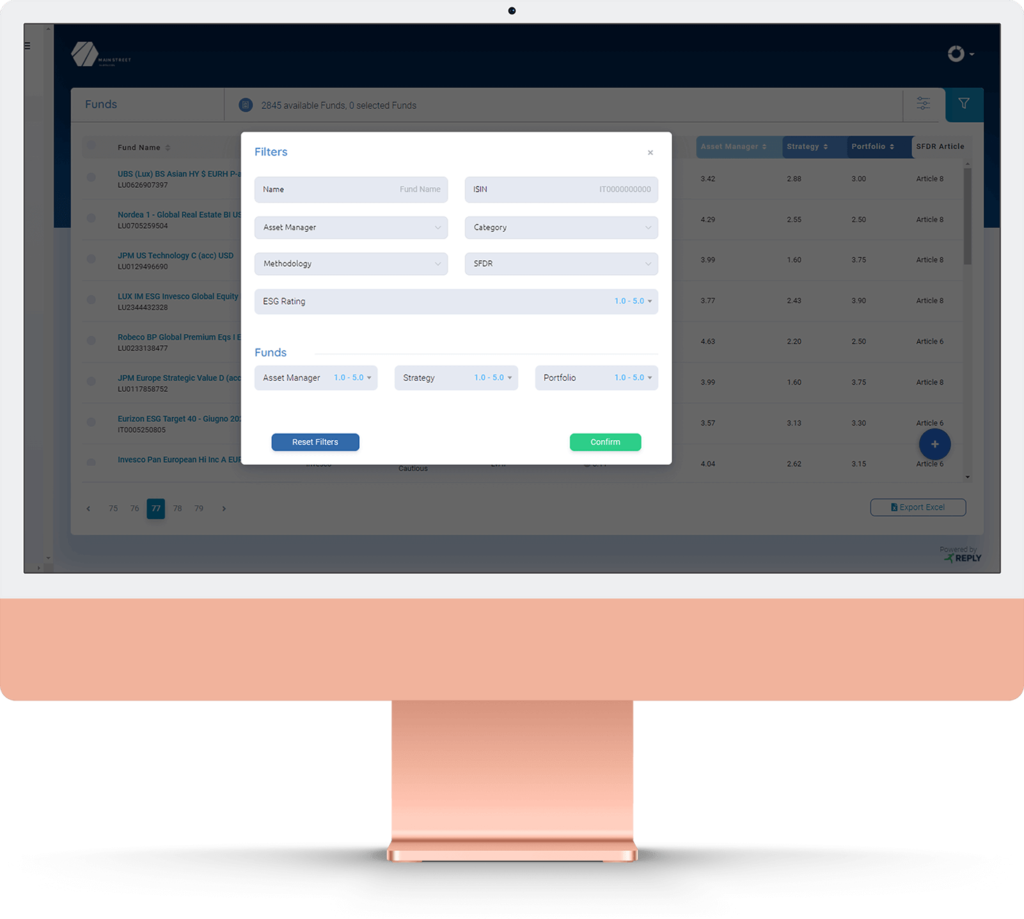

2. Specialised Data Providers

A few specialised providers are now incorporating EU Taxonomy alignment data within their offerings. These platforms typically extract, aggregate and standardise data, providing detailed output and reports on Taxonomy alignment, of companies, and of investment portfolios. Some specialised EU Taxonomy Services include data focused on percentage and value of Eligibility, Alignment, Alignment to Transitional Activities, and Reported exposure to Nuclear and/or Gas activities. These services can be particularly helpful for investors who aim to produce regulation compliant reports.

3. European Commission and EU Bodies

The European Commission often publishes guidance and data relevant to the EU Taxonomy, including sector guidelines, technical screening criteria, and transition metrics. The European Environment Agency (EEA) publishes environmental data that aligns with the EU’s sustainability objectives, which can support contextual analysis for Taxonomy alignment, especially for impact and outcome-based reporting. The EU Open Data Portal provides free access to a range of data related to the EU Taxonomy, sustainability metrics, and environmental benchmarks. In addition, certain EU member states offer national databases for environmental and economic data that align with Taxonomy metrics, which can help investors understand regional alignments.

4. Corporate Engagement and Surveys

Engaging directly with companies through surveys or direct requests can provide insights into EU Taxonomy alignment, especially for private or smaller companies that may not disclose full alignment publicly. Organizations like the PRI (Principles for Responsible Investment) and industry-specific working groups sometimes gather and distribute Taxonomy-aligned data, especially where public disclosure is limited.

Using a combination of these resources, investors can gather and incorporate EU Taxonomy data into their sustainability and financial reports, aligning their portfolios with regulatory expectations and improving transparency around their sustainability impact.

This article first appeared on Wealth DFM